price to cash flow from assets formula

Market cap can typically be found with many stock quotes along with other common stock metrics. The formula for the Price to Cash Flows ratio or PCF is a companys market capitalization divided by its cash flows from operations.

Cash Flow Formula How To Calculate Cash Flow With Examples Positive Cash Flow Cash Flow Formula

No Financial Knowledge Required.

. Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance. Your answer is 10 which means that investors pay 10 for every dollar of cash flow. Operating cash flow is mentioned in the cash flow statement of the annual report.

The price to cash flow ratio is most useful when companies have negative earnings but positive operating cash flows. 24000 -10000 2000 16000. PCF Price per Share Operating Cash Flow per Share.

This results in the following cash flow from assets calculation. Ad QuickBooks Financial Software. Rated the 1 Accounting Solution.

5 Accredited Valuation Methods and PDF Report. The companys cash flow from assets may indicate to buyers that purchasing the company is a good value. The numerator market capitalization is the total value for.

Johnson Paper Companys cash flow from assets for the previous year is 16000. Cash Flow on Total Assets Ratio Formula. Is the net cash flow from operating activities in the statement of cash flow.

Financing Activities 5000. How is the price to cash flow ratio calculated. W Changes in net working capital.

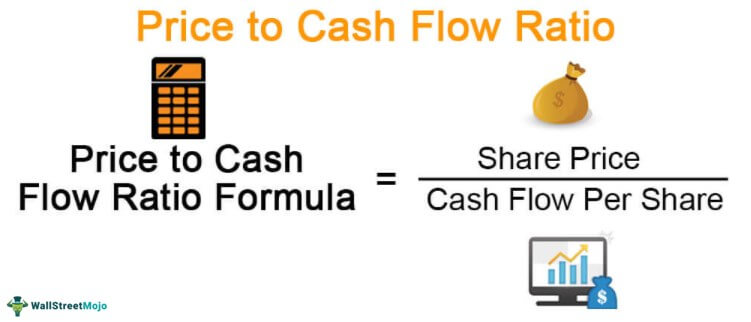

Cash flow represents your businesss free cash flow. Beginning Cash 50000. The Price to Cash Flow ratio formula is calculated by dividing the share price by the operating cash flow per share.

The price-to-cash flow ratio can serve as an indicator of investment valuation. Cash flow per share Cash Flows from Operating Activities Weighted-Average Number of Shares 30 million 2 million 15 per share. Price to Cash flow Ratio Current Stock Price Cash Flow per Share 50 15 333.

Cash flow from operations. Operating Activities 30000. Cash Flow from Assets Calculator.

Price to Cash Flow Ratio Share Price Cash Flow Per Share As you can see to calculate the price-to-cash-flow ratio you merely take the price per share of. You can easily calculate the price to cash flow ratio by using the following formula. DCF Cash Flow 1 r 1 Cash Flow 1 r 2 Cash Flow 1 r n Lets breakdown the formula as follows to understand it better.

Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital. You divide the share price by the operating cash flow per share. Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow.

Investing Activities 5000. Price to cash flow from assets formula. Heres how this formula would work for a company with the following statement of cash.

The price to cash flow ratio is calculated by using the following formula. How to analyze the price-to-cash flow ratio. 50 5 10.

Ad Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal. N Net capitalspending. Now you must find the price-to-cash flow ratio.

C a s h F l o w o n T o t a l A s s e t s C a s h F l o w f r o m O p e r a t i o n s A v e r a g e T o t a l A s s e t s. Johnson Paper Companys cash flow from assets for the previous year is 16000. This is a positive cash flow.

Price to Cash Flow Share Price or Market Cap Operating Cash Flow per share or Operating Cash Flow The PCF ratio equation can also be calculated using the market cap like this. 12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in working capital 15000 payables - 30000 receivables - 10000 inventory -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets. Price-to-Cash Flow PCF Market Capitalization Cash Flow from Operations The formula for PCF is simply the market capitalization divided by the operating cash flows of the company.

When is the price to cash flow ratio most useful. In case of Frost we need to estimate operating cash flows and then work out PCF as follows. The numerator market capitalization is the total value for all stocks outstanding for a company.

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

What Does Price To Cash Flow Indicate Positive Cash Flow Cash Flow Financial Analysis

Cash Flow Ratios Calculator Double Entry Bookkeeping Cash Flow Statement Cash Flow Learn Accounting

Cash Flow From Operating Activities Learn Accounting Cash Flow Statement Accounting Education

How To Calculate Ebitda Financial Analysis Cash Flow Statement Financial Analyst

Debt Ratio Bookkeeping Business Debt Ratio Learn Accounting

How Do I Use The Accounting Equation In My Business Small Business Finance Cash Flow Statement Sell Your Business

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Small Business Resources

Price To Cash Flow Formula Example Calculate P Cf Ratio

Interval Measure Meaning Importance How To Calculate Burn Rate And Defensive Interval Ratio Financial Analysis Cash Flow Statement Financial Management

1 J 23 I E U This Document Kee Cash Flow Statement Knowing You Sales Revenue

Cash Flow Formula How To Calculate Cash Flow With Examples

7 Cash Flow Ratios Every Value Investor Should Know

Small Business Accounting Archives Mirex Marketing Accounting Small Business Accounting Bookkeeping Business

Free Cash Flow Operating Cash Ratio Free Cash Cash Flow Cash

Cash Flow From Investing Activities Overview Example What S Included

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Cash Flow Formula How To Calculate Cash Flow With Examples

Myeducator Business Management Degree Accounting Education Accounting Classes